Managing finances properly is mainly common sense. While we’ve all made financial mistakes, most of those mistakes are easily rectified, particularly when...

Read More

Puerto Ricans flooded the streets of San Juan this week to protest a government many of them see as dishonest and even scornful toward the island’s people. A

Read More

Here we are on the eve of another rate-setting meeting by the Federal Open Market Committee (FOMC), and the markets seem to be

feeling pretty good. The Dow

Read More

The European Parliament (EP) is an important forum for political debate and decision making at the European Union (EU) level. The Members of the European

Read More

If you’re a beginning investor, it’s likely you’re concentrating on building your portfolio. But as important as it is to build that portfolio, you should also

Read More

As millions tuned in to watch the HBO series Game of Thrones in its series finale this past weekend, deteriorating trade relations between China and the U.S

Read More

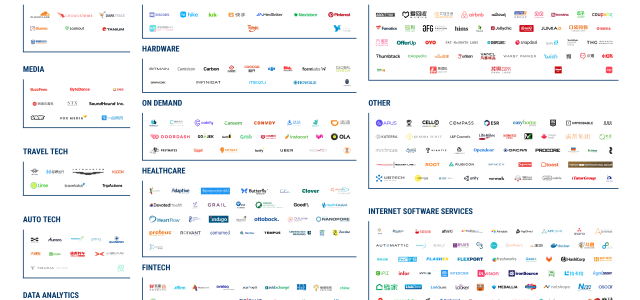

Unicorns are mythical creatures, whose sitings are supposed to be rare, but they are spotted in herds these days, especially their initial public offering (IPO)

Read More

As the summer months approach, it is time for the usual rise in gas prices. This seasonal trend is normal, as demand for gas increases with the warming weather

Read More

Yesterday was the last day for individuals to file their tax returns, and many Americans could be looking at a different situation this year from previous years

Read More

Domestic equity markets continued to post positive returns for March, although at reduced rates when compared with performance for January and February. All

Read More

On Friday, March 22, the yield on the 10-year US Treasury Note fell below the 3-month yield, suggesting that buyers expect the economy is on a downward

Read More

Happy Spring Equinox. Spring is in many ways a rebirth of the year. It is a natural time for us to pause, reflect, clean house, evaluate progress, and plant

Read More